From OG @Vivian

Beginner Advice

I’m a noob too, so no worries. For beginners, I recommend starting small and focusing on conviction plays in mid- to long-term investments with shares or long-dated LEAPS. These tend to have less execution risk and fewer mind games that can shake you out of a position.

It’s great to learn and enjoy yourself, but if you have a small bankroll, prioritize growing it through business, side hustles, or your career. These avenues have a much higher chance of growth than trying to day trade $500 into $1 million.

Beware of anyone trying to sell you anything. 🍀

- WTF (AfterHour 👑🐳): Plays options a few months out, catches red day knives when he has a thesis behind the play and the underlying may be down unfairly. Often doubles, triples, or quadruples down on trades. You must understand the risk in proportion to your bankroll, not the dollar amount. For example, if he bets $5 million and that’s only 10% of his bankroll, you shouldn’t go all-in. Be cautious with shorter-dated options as they can expire worthless quickly.

- Cantonmeow on X: A great follow for a more patient, higher-timeframe approach with shares. This has a higher chance of success. He gives his entries via tweets but is mostly already positioned, still adding weekly with paychecks.

Recommended X.com Follows:

- @cantonmeow: My top alpha/follow. High time frame technical analysis, all shares. Catches some knives and likes good entries.

- @StockPatternPro: Alien charts, but really good; nails many predictions.

- @ripster47: Focuses on short-term news, intraday fundamental and technical trends.

- @miragemogul: Great low time-frame calls on crypto/miners this year. Respected technician.

- @briantycangco: Focuses on China news/perspectives.

- @financialjuice: Sometimes too many less important data points.

- @ShortsellerST: Charts, sharp insights, and some small-cap gems.

- @marketmaestro1: Charts, lots of tickers. Patreon has more color, even with non-paid access.

Crypto-specific follows:

- @TVRN20

- @ChartingGuy

- @Crypt0mer

- @News_Of_Alpha

- @Dentoshi

- @QuantMeta

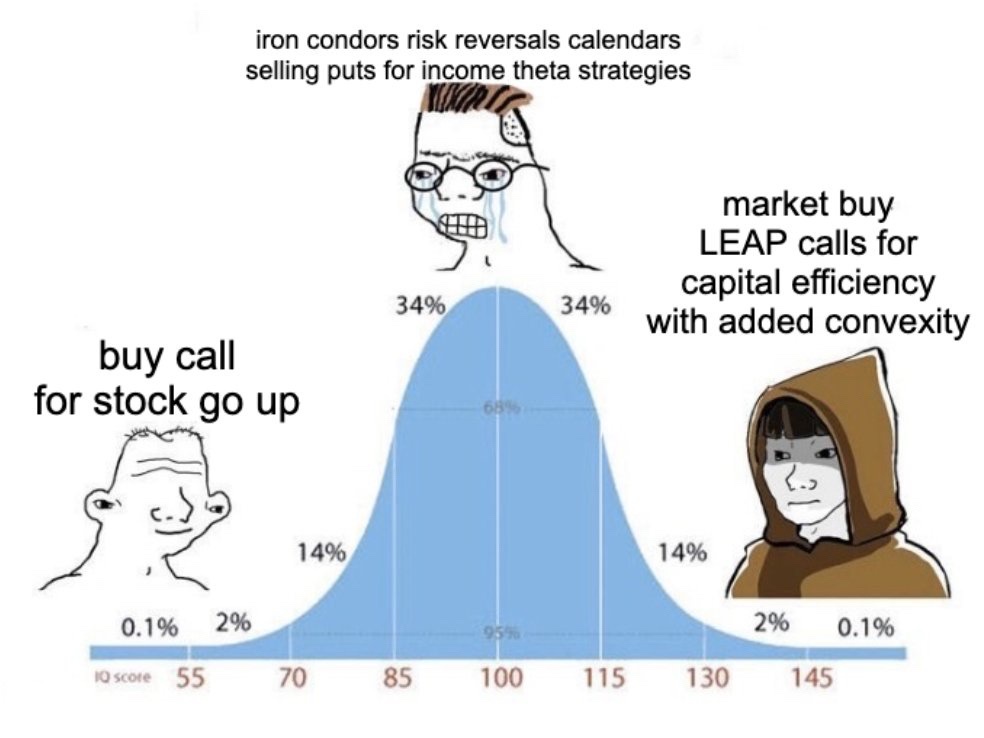

Super New to Options?

Make sure to use limit orders instead of market orders. When buying options, especially with larger spreads on smaller stocks or out-of-the-money strikes, use a “limit buy” order. You’ll see a bid and ask. Typically, halfway between will fill and is much better than market price. Start bidding lower closer to the bid, then move it up closer to halfway if it doesn’t fill.

Also, the first 30-60 minutes of each trading day often have more expensive premiums since everyone is trying to get in at the same time—though individual stock moves can affect this.

Good calculator with IV slider: Optionstrat – Use the “Build Long Call” feature to estimate your potential gain based on the underlying price at different points in time. Sometimes using this along with support/resistance levels can help in planning.

Not a Pro But Learn Fast

If you like the info I curate, follow @token on AfterHour. I post interesting finds in his daily discussion threads throughout the day.

Good advice on taking profits gradually:

Link to post

TLDR: Don’t hesitate to take 30% or partial profits on pumps when your coin, stock, or calls run. You can use that capital to redeploy into other coins when they dip or into new launches with good potential. If the original asset goes to the moon, you still have a significant bag left and are still happy.