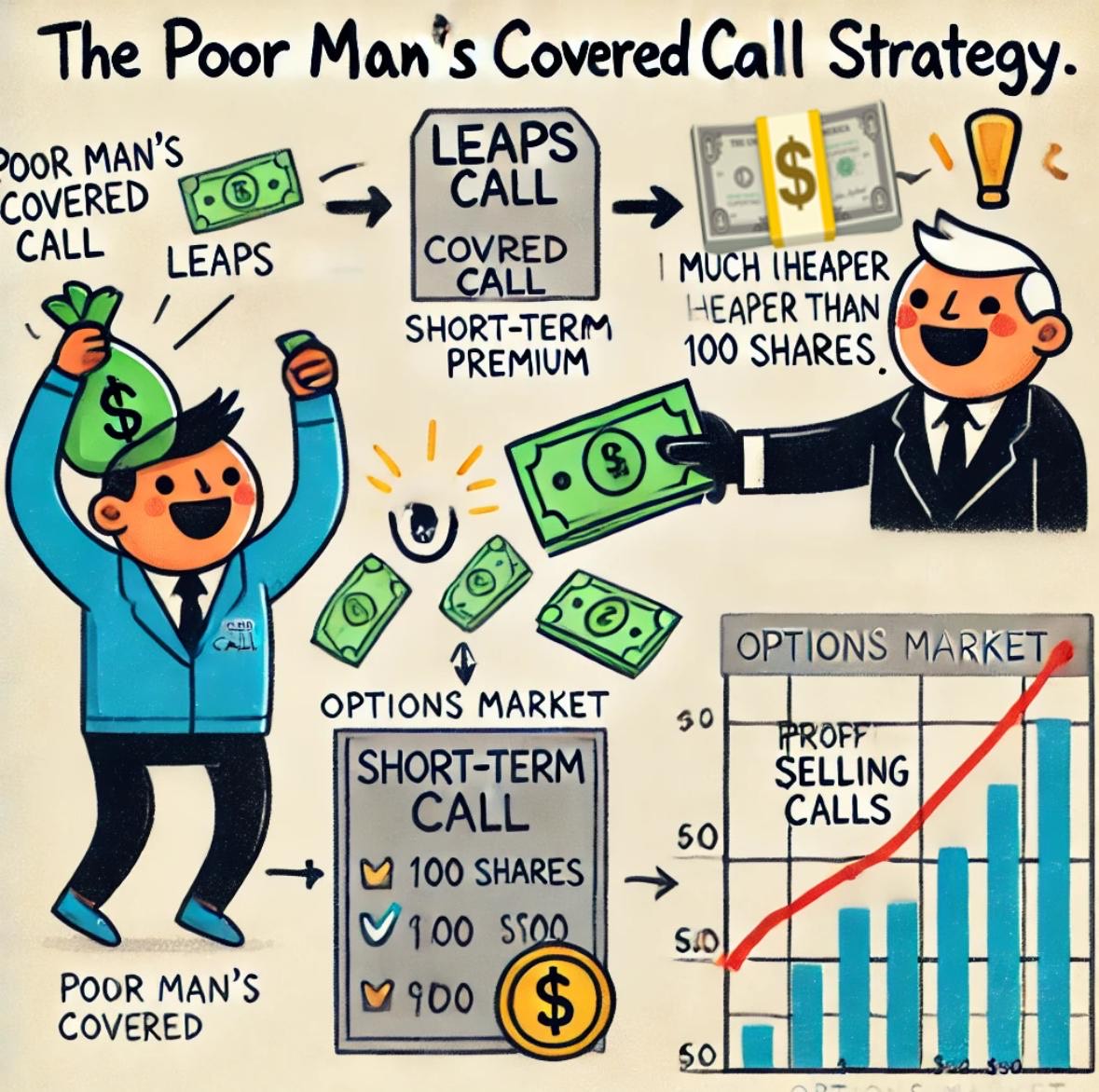

💡 Want to make money selling calls but don’t have the cash for 100 shares? No worries! There’s a cheaper way, the Poor Man’s Covered Call (PMCC) or Synthetic Covered Call.

How It Works (Super Simple!)

✅ Buy a long-term call (LEAPS) – This is your “discounted” stock that gives you the right to buy shares later.

✅ Sell a short-term call – This is how you collect premium 💰, just like a regular covered call!

Why It’s Cool

✔️ Way cheaper than buying 100 shares

✔️ Generates passive income from selling calls

✔️ Uses leverage smartly (but don’t go crazy!)

Real Example

📌 $MSTR is $329.20 – Buying 100 shares costs $32,920! Instead, you:

👉 Buy ITM LEAPS call (expires next year or near a year, depending on your budget)

🔹 $300 strike price costs around $11,600 – Way less than $32,920 to control 100 shares!

📉 Best time to enter? When the stock is down + IV is down!

👉 Sell a short-term call and collect $1,200 every few weeks? (If things go in your favor!) Maybe the $345 strike price on Feb 21?

💥 Boom! You’re running a covered call strategy without needing a fortune.

What’s the Risk?

⚠️ If the stock moons past your strike price, you cap your gains. But hey, that’s the trade-off for spending way less upfront!

💬 Ever tried the Poor Man’s Covered Call? Let me know in the comments!

🔹 PS: This is not financial advice. Always do your own research and consult your financial advisor or broker to understand the risks involved.